Learn how plastic surgery loans can help make your dream procedure affordable with flexible financing options and low monthly payments.

Last updated:

September 21, 2025

Making Your Dream Procedure Affordable

For many people, the idea of undergoing plastic surgery is exciting—it offers the chance to enhance your appearance, boost confidence, and achieve your ideal look. However, the cost of these procedures can often be a barrier, leaving many wondering if they can afford the transformation they desire.

Fortunately, plastic surgery loans have become an increasingly popular way to finance cosmetic procedures, making them accessible to more individuals. In this article, we'll explore how plastic surgery loans work, the benefits of financing your surgery, and tips on finding the right loan to make your dream procedure affordable.

The Cost of Plastic Surgery: Understanding the Financial Commitment

Plastic surgery procedures vary widely in cost depending on the type of surgery, the surgeon's expertise, and geographic location. On average, here are the estimated costs for some popular cosmetic procedures:

- Breast Augmentation: $6,000 - $12,000

- Rhinoplasty (Nose Job): $7,000 - $15,000

- Liposuction: $6,500 - $10,500

- Facelift: $9,500 - $20,000

- Tummy Tuck: $9,000 - $15,000

These figures can be overwhelming, but plastic surgery loans provide a way to break down the total cost into manageable monthly payments, allowing you to get the procedure you want without waiting for years to save up.

What Are Plastic Surgery Loans?

Plastic surgery loans are specialized personal loans designed to cover the cost of cosmetic procedures. They allow patients to finance their surgeries upfront and then repay the loan over a set period, typically with monthly installments.

These loans can be offered by a variety of lenders, including banks, credit unions, online lenders, and even specialized medical financing companies. The loan terms, interest rates, and monthly payments vary depending on your credit score, loan amount, and lender policies.

How Do Plastic Surgery Loans Work?

Plastic surgery loans operate much like traditional personal loans but are tailored specifically for cosmetic procedures. Here’s a breakdown of how they work:

1. Application Process

To apply for a plastic surgery loan, you'll typically need to provide basic personal and financial information, including your credit score, income, and the estimated cost of the procedure. Most lenders offer an online application process, and approval can often happen within minutes.

2. Loan Approval

Once you’re approved for the loan, you’ll receive the funds, which can be used to pay for your surgery. In some cases, the lender may pay the surgeon or clinic directly. The loan amount will include the total cost of the procedure, and you’ll agree to a repayment plan that outlines your monthly payments and interest rate.

3. Repayment Terms

Repayment terms typically range from 6 to 60 months, depending on the loan amount and lender. The longer the repayment term, the lower your monthly payments will be, though you may pay more in interest over time.

Benefits of Financing Your Plastic Surgery with a Loan

Plastic surgery loans offer several advantages that make them an attractive option for patients who want to proceed with their dream procedure without delay.

1. Immediate Access to Your Procedure

One of the primary benefits of plastic surgery loans is that they allow you to undergo surgery right away, rather than waiting until you’ve saved enough money. This means you can achieve your desired look sooner and start enjoying the benefits of your procedure without postponing it for years.

2. Affordable Monthly Payments

With a plastic surgery loan, you can spread the cost of your procedure over a period of time with manageable monthly payments. This makes it easier to fit into your budget, allowing you to pay for your surgery without financial strain.

3. Fixed Interest Rates

Many plastic surgery loans come with fixed interest rates, meaning your monthly payments stay the same throughout the loan term. This offers predictability and ensures that there are no surprise increases in your payment amounts.

4. Flexible Loan Terms

Plastic surgery loans offer flexible repayment terms, allowing you to choose a plan that works best for your financial situation. You can opt for a shorter term to pay off the loan more quickly or a longer term to lower your monthly payments.

5. No Upfront Payments

Many patients struggle with the upfront costs of plastic surgery, but with a loan, you can cover the entire procedure without needing to make a large payment on the day of surgery. This eliminates the stress of having to gather a large sum of money before your surgery date.

How to Find the Right Plastic Surgery Loan for You

Not all loans are created equal, so it’s important to compare your options and choose the right financing solution for your needs. Here’s how to find the best plastic surgery loan:

1. Compare Interest Rates

The interest rate you’ll pay on your loan is a crucial factor in determining the total cost of borrowing. Look for loans with competitive interest rates, and consider using an online comparison tool to find the best offers. Your interest rate will depend on your credit score, with higher scores typically receiving lower rates.

2. Check for Additional Fees

Some lenders charge additional fees, such as origination fees or prepayment penalties. Be sure to read the fine print and understand the full cost of the loan, including any extra charges, before committing.

3. Review the Loan Term

Consider the length of the loan term when comparing options. While a longer loan term can lower your monthly payments, it may result in paying more in interest over time. Choose a repayment plan that balances affordable payments with minimizing the total cost of the loan.

4. Consider Your Credit Score

Your credit score plays a significant role in determining your loan approval and interest rate. If your credit score is on the lower side, consider working on improving it before applying for a loan to secure better rates. Some lenders may offer loans to individuals with less-than-perfect credit, but at higher interest rates.

5. Check for Medical Financing Programs

Some plastic surgery practices partner with medical financing companies like CareCredit, Cherry or Alpheon Credit, which offer specialized loan programs designed for cosmetic surgery. These programs often feature low- or no-interest promotional periods, making them a good option for those who can pay off their loan quickly.

How Plastic Surgery Loans Can Help You Achieve Your Goals

Financing your plastic surgery can make your dream procedure much more accessible, allowing you to enjoy the benefits of cosmetic enhancements without financial stress. Whether you're interested in a facelift, liposuction, or breast augmentation, plastic surgery loans provide an easy way to budget for your transformation.

With flexible repayment terms, affordable monthly payments, and access to the latest procedures, loans make it possible for individuals from all walks of life to afford cosmetic surgery and feel confident in their appearance.

Making Your Dream Procedure Affordable

If you’ve been considering plastic surgery but are concerned about the cost, a plastic surgery loan might be the perfect solution. By breaking down the total cost into affordable monthly payments, you can proceed with your dream procedure without delay and achieve the results you’ve always wanted.

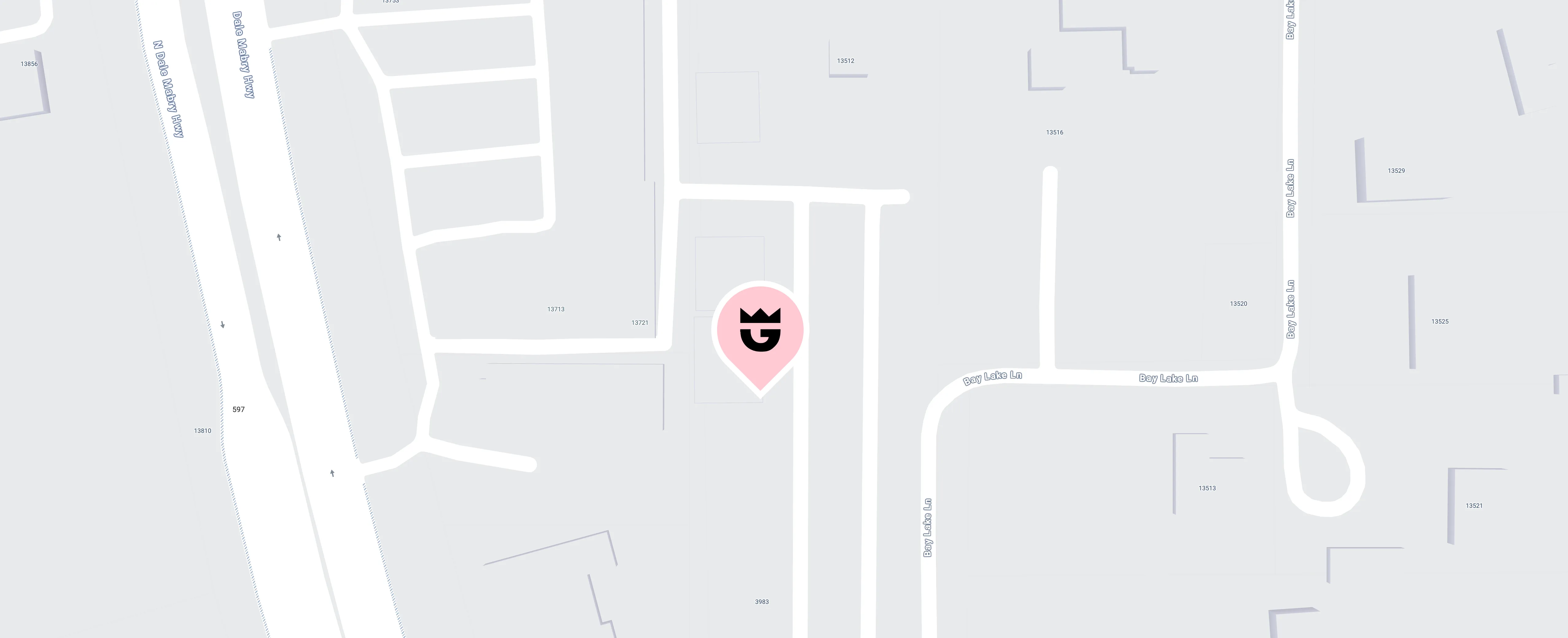

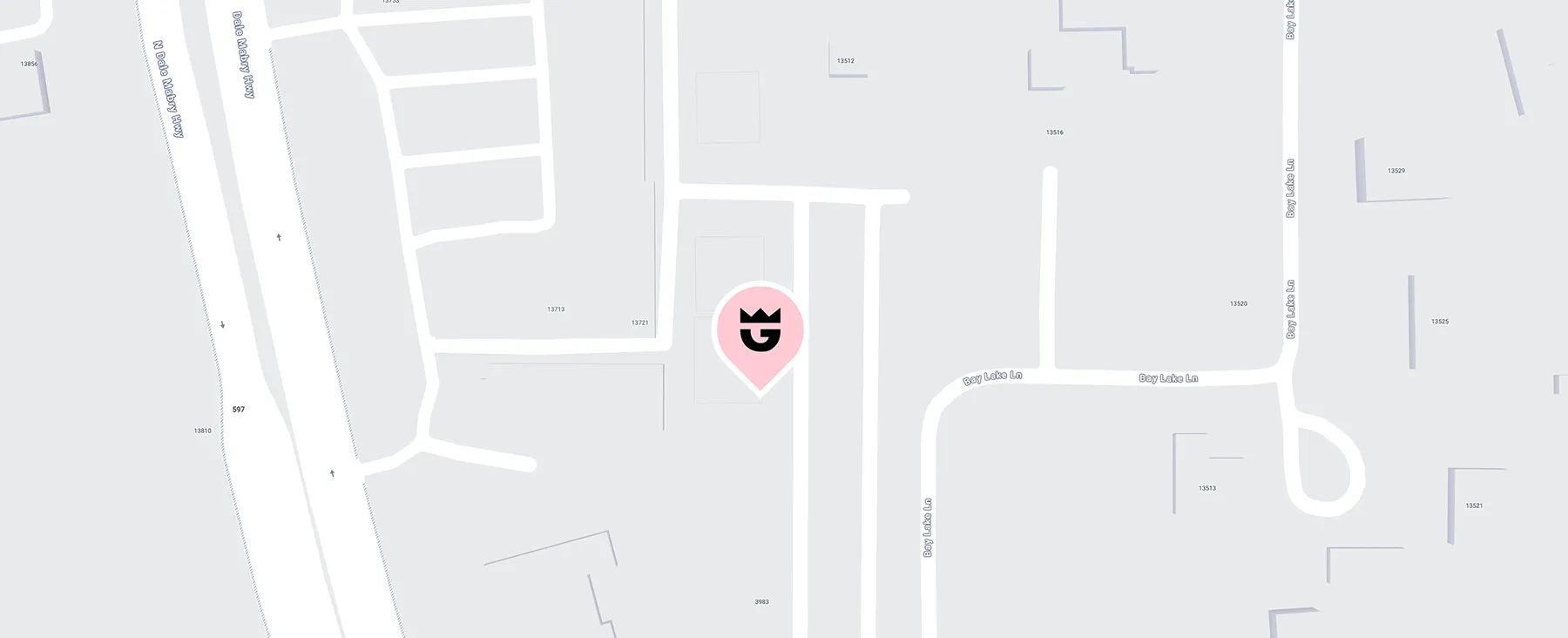

Remember, it’s important to choose a board-certified plastic surgeon like Dr. Meegan Gruber, who offers comprehensive consultations and personalized treatment plans. With the right surgeon and financing plan, your ideal look is within reach.

%402x%20(2).svg)